Seeds of Change: Navigating the Highs and Lows of Europe's Indoor Vertical Farming Industry

From Technological Innovation to Market Readiness: A Comprehensive Look at the Strengths, Weaknesses, Opportunities, and Threats Shaping the Future of Vertical Farming in Europe.

The indoor vertical farming industry in Europe is currently going through a dynamic phase, with a number of startups successfully raising funds for their equipment. While the Netherlands serves as a hub for indoor vertical farming, the sector still faces several challenges, including high initial costs, energy consumption, and a lack of skilled labor.

However, there are also opportunities in the form of sustainability and increasing consumer demand for locally-grown produce. It should be noted that this sector is vulnerable to technological disruptions and cyber threats.

Strengths

Technological Innovation & Investments

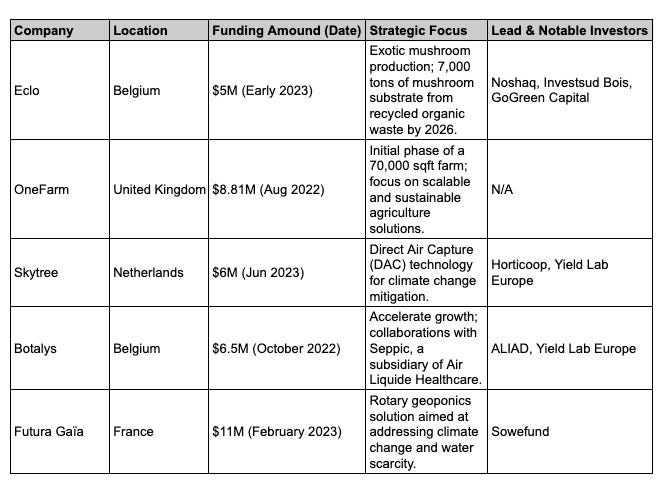

The European indoor vertical farming industry is in a dynamic phase, marked by a surge in technological innovation and robust investment activity despite a contraction. In addition to the examples cited in the table below, we find companies such as Avisomo, which bagged a $2.5M funding round to further its development or Skytree, which bagged $6M to develop further its direct air capture technology for climate change mitigation.

Some notable funding rounds since 2022. Source: igrownews.com

Indeed, despite the contraction we have seen with many European companies filling for bankruptcies, companies are scaling down their plans/projects and their company size. Startups still manage to raise funds, particularly companies that offer equipment.

Europe has increasingly become a magnet for investment, particularly in emerging technologies. The region boasts a robust investment climate characterized by a well-developed financial ecosystem, favorable government policies, and a strong focus on sustainability and innovation. Venture capital firms, angel investors, and public funding initiatives are actively seeking opportunities in groundbreaking technologies, ranging from artificial intelligence and blockchain to renewable energy and sustainable agriculture. A rich tapestry of research institutions, technology hubs, and a highly skilled workforce further bolstered this investment-friendly environment. In April 2023, the EU is preparing to invest about $200M in breakthrough digital technologies in Europe. An article from the French newspaper Le Monde mentioned that more than 50% of seed investments go to companies contributing to the UN’s Sustainable Development Goals.

Regarding Indoor Vertical Farming, the European hub for innovation and development in this sector is the Netherlands. The country leverages its history in the greenhouse industry, the presence of historical research institutes such as Wageningen, and reputed regions such as Westland for greenhouses. Despite the size of the country (compared to other neighboring countries), they managed to develop a significant horticulture and fresh produce industry to become today one of the leading producers of vegetables and fruits in Europe. Nevertheless, the number of greenhouse horticulture farms has been falling since 2007 in the Netherlands, dropping from 1,549 in 2007 to 822 in 2021, according to Statista, and the crisis linked to the energy price hikes after the Russian war has further damaged the companies present in the country.

Market Readiness

In Europe, the concept of locally sourced food has found fertile ground, resonating strongly with a population increasingly concerned about sustainability, food security, and environmental stewardship. The farm-to-table movement emphasizes the importance of knowing where your food comes from and how it's produced and has gained significant traction across various European countries. This is not just a trend but a shift in consumer behavior, influenced by a rich history of regional cuisines and local farming traditions. European consumers are more willing to pay a premium for locally sourced products, viewing them as fresher, more sustainable, and more trustworthy than imported goods.

The European Union's policies also reflect and reinforce this sentiment. Various initiatives and certifications, such as the Protected Designation of Origin (PDO) and Protected Geographical Indication (PGI), aim to promote and protect local food cultures and industries. These labels help consumers make informed choices, further driving the demand for local produce. Moreover, educational campaigns about the environmental impact of food transportation have led to greater public awareness about the carbon footprint associated with importing food from far-flung regions. As a result, 'food miles' have become a part of the European consumer's vocabulary, influencing purchasing decisions in favor of local options.

Community-supported agriculture (CSA) programs, farmers' markets, and local food festivals are flourishing, offering platforms for small-scale farmers and artisanal producers to connect directly with consumers. The success of these platforms indicates a community-driven approach to food sourcing, where producers and consumers are stakeholders in a localized food system. This boosts local economies and fosters community and shared responsibility for sustainable living.

Weaknesses

While the indoor vertical farming sector in Europe shows promise, it is not without its challenges and weaknesses that could hinder its growth and scalability. One of the most glaring issues is the high initial capital expenditure required to set up a vertical farm. Acquiring land in urban areas and the investment needed for state-of-the-art technologies like LED lighting, automated systems, and climate control can be inexpensive. This financial barrier to entry limits the number of players who can participate in the market, potentially stifling innovation and competition.

Energy consumption is another significant concern. Vertical farms rely heavily on artificial lighting and climate control systems, which can be energy-intensive. While some farms are exploring renewable energy options, the sector as a whole has yet to find a sustainable solution to offset its carbon footprint fully. This is particularly problematic given Europe's strong focus on sustainability and reducing greenhouse gas emissions. The energy issue impacts the environment and adds to operational costs, which could be passed on to consumers, making the produce less competitive than traditionally farmed goods. Moreover, last winter's energy crisis has further hindered indoor vertical farm profitability.

Additionally, the sector faces challenges related to labor and expertise. Skilled labor in data analytics, plant biology, and systems engineering is essential for the efficient operation of vertical farms. However, there is a noticeable skills gap in the market, and attracting qualified personnel can be difficult and costly. Furthermore, the European market is diverse, with varying consumer preferences and regulatory landscapes across different countries. This requires vertical farming companies to adapt their strategies and products to meet local demands, adding another layer of complexity to their operations. In summary, while indoor vertical farming in Europe has significant potential, overcoming these weaknesses will be crucial for the sector's long-term viability and growth.

Opportunities

Europe's indoor vertical farming sector is ripe with opportunities that could propel it into a leading position globally. One of the most significant opportunities lies in the realm of sustainability. As climate change continues to impact traditional agriculture, vertical farming offers a more sustainable alternative that uses less water, land, and pesticides. This aligns well with Europe's solid environmental sustainability focus and could attract public and private investment. Moreover, the European Union's commitment to the Green Deal, which aims to make the EU's economy sustainable by turning climate and environmental challenges into opportunities, could provide financial incentives and policy support for vertical farming initiatives.

Another opportunity is the growing consumer demand for locally sourced, organic produce. The farm-to-table movement is gaining traction across Europe, and vertical farms have the potential to deliver fresh, local produce year-round, irrespective of climate conditions. This appeals to consumer preferences and reduces transportation costs and associated carbon emissions. The proximity to urban centers also allows for quicker response to market demands, offering a competitive advantage over traditional farming. Furthermore, vertical farming can contribute to food security, a concern heightened by supply chain disruptions caused by events like the COVID-19 pandemic and extreme weather conditions.

Technological advancements also present a significant opportunity for the sector. Europe is home to some of the world's leading agricultural technology companies and research institutions. Innovations in artificial intelligence, machine learning, and the Internet of Things (IoT) can be integrated into vertical farming operations to optimize yield, reduce waste, and lower operational costs. Collaborations between tech companies, research institutions, and vertical farming enterprises could accelerate the development and adoption of these technologies. In summary, the confluence of sustainability goals, consumer preferences for local produce, and technological advancements creates a fertile ground for the growth and expansion of Europe's indoor vertical farming sector.

Threats

While Europe's indoor vertical farming sector is burgeoning with potential, it also faces several threats that could hinder its growth and scalability. One of the most pressing threats is the high initial capital investment required for setting up vertical farms. The cost of acquiring land in urban or peri-urban areas and the expenses for advanced technologies like LED lighting, climate control systems, and automated harvesting can be prohibitive. This financial barrier could deter new entrants and limit the sector to more prominent players with the capital to invest, thereby reducing market diversity and competition.

Hyperinflation is also further hampering the sector's growth as the current prices increase operational expenses while decreasing the consumer's ability to pay. In France, food prices have increased by 16% in a year, and the volume sold in retail stores has decreased by 5%.

Another significant threat is the regulatory landscape. As vertical farming is a relatively new industry, it is still subject to evolving regulations concerning food safety, pesticide use, and environmental impact. Any stringent regulatory changes could increase operational complexities and costs for vertical farming businesses. Moreover, the sector could face challenges in standardizing produce quality and safety, which is critical for gaining consumer trust and the export market. The European Union's complex regulatory framework could pose additional challenges, especially for startups that need more resources to navigate these regulations effectively.

The energy sector in Europe is precariously balanced, and the current trends further exacerbate its fragility. These innovative farms are power-intensive, requiring substantial electricity for artificial lighting and climate control systems. As Europe grapples with a transition to renewable energy, the sector becomes susceptible to fluctuations in energy availability and cost escalations. These variables could severely dent the profitability of vertical farms.

Moreover, the ongoing public discourse over the choice of energy sources adds another layer of complexity, influencing market dynamics and driving up energy prices. This debate not only impacts the energy sector but also trickles down to vertical farming, making it even more financially challenging to operate these farms sustainably.

The sector is also alarmingly vulnerable to technological disruptions and cyber threats, owing to its heavy reliance on advanced automation and data analytics. A cyber-attack could jeopardize the farming operation, resulting in financial losses and a tarnished reputation.