Indoor Vertical Farming Investments Have Now Crossed USD 2.4Bn in 2022

Investments & funding rounds have crossed the USD 2.4 Bn mark since Gotham Greens' USD 310 Million Series E, surpassing investments made in 2021 despite an investment drop fear.

Good morning readers, Gotham Greens bagged a USD 310 million funding round sending total investments made in indoor vertical farming companies to an impressive USD 2.4 Billion in 2022 (and the year is not finished). This growth is impressive given the macroeconomic conditions we are experiencing in terms of inflation, interest rate hikes and the slow fall in Venture volume in emerging sectors/ companies.

Nonetheless, these investments appear to be clustered in a handful of countries and companies fearing potential consolidation phases as well as potential missed opportunities. Moreover, the funding rounds fuels the fear on an investment frenzy and perhaps a future swift reversal on investments made in the sector…

Investments in Indoor Vertical Farming Continue To Grow, Unlike Other Emerging Sectors

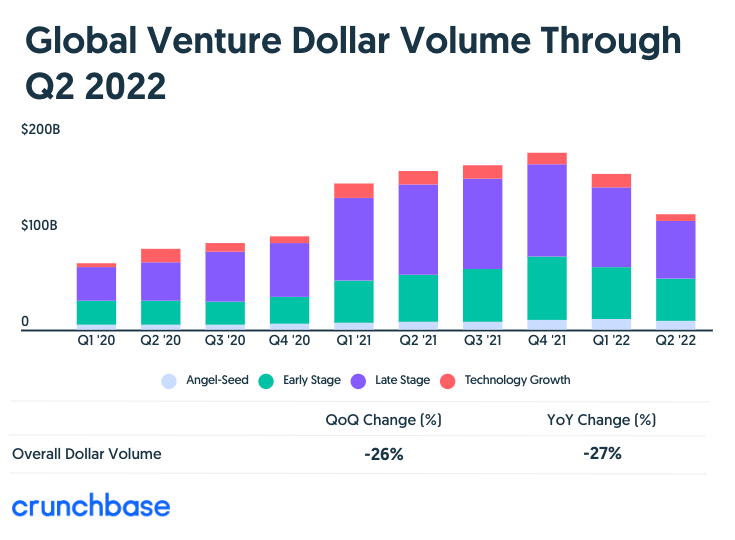

Recent Crunchbase data shows that global funding dramatically dropped in volume in the second quarter 2022 especially from later-stage funding bets. Funding reached $120 billion, the lowest amount recorded for a single quarter since the beginning of 2021.

As seen in the graph above, funding fell by 26% in the quarter compared to the previous year’s quarter contrasting with the investment growth indoor vertical farming has experienced this year.

Why is that?

Given the current macroeconomic conditions, with exponential inflation rates throughout the world, interest rates hikes from central banks, and other geopolitical tensions we could question whether this trend can continue over the next months.

“You would not be blamed for thinking that market conditions should have made it hard for the indoor farming sector to repeat its record year of capital raising last year. However, at this point investment into indoor farming shows no sign of slowing down in 2022” Mentions Adam Bergman, the Global Head of AgTech Investment in Citi, on a recent LinkedIn post “As the indoor farming sector matures, consolidation should accelerate, particularly among greenhouse growers.”

Commenting on that, Light Science Technologies CEO & Founder, Simon Deacon says:

"The events that occurred in 2022 added to the pre-existent issues in terms of diminishing arable land and labour shortages constitute favorable arguments for AgTech and indoor vertical farming growth. To illustrate with an example, labour shortages in the UK have resulted in crops valued at more than £36m being destroyed with the number of applicants for seasonal workers dropping dramatically. With the added losses incurred because of the heatwaves experienced this summer, the effects of the Ukrainian war and the rising energy prices, all this could be offset using adapted indoor vertical farming technologies."

Record-Breaking But Clustered Investments in Indoor Vertical Farming

Despite the net increase in investments made in indoor vertical farming companies, 4 entities concentrated 49.6% of the investments made (Plenty, Gotham Greens, Little Leaf Farms, and Pure Harvest Smart Farms) totalling about USD 1.19Bn in investments.

Plenty Secured USD 400 Million Series E

In January, Plenty announced it secured a USD 400 million in a Series E funding round. This funding round is the larget to-date for an indoor farming company and was led by new investors One Madison Group & JS Capital, including participation from Walmart and existing investor SoftBank Vision Fund 1.

The Funding round aims at improving and scaling the companies’ technology throughout the US. Commenting on the funding round, Omar Asali, Chairman and CEO of One Madison Group mentions that "indoor farming is at an inflection point, poised to reach its full potential” given the pressing needs the world is experiencing. Adding to that, Arama Kukutai, Plenty’s CEO adds that having Walmart partnering with us demonstrates “the rising importance of indoor agriculture to the future of fresh food”

Gotham Greens Nets a USD 310 Million Funding Round & Acquires FresH20

Earlier this week, Gotham Greens banked more than USD 310 million in new capital including both equity and debt funding led by new investors BMO Impact Investment Fund (IIF) a sustainability-focused investment fund of the Bank of Montreal (BMO) (NYSE: BMO), and Ares Management funds (Ares). The Series E round will use the funding to “accelerate its mission to decentralize agricultural production and bring more greenhouse-grown produce and fresh, plant-based foods to people across the United States” as per the company’s most recent press release.

The funding will also contribute to the company’s expansion strategy in the United States with new greenhouse projects currently under construction in Seagoville, Texas (near Dallas), Monroe, Ga. (near Atlanta) and Windsor, Colo. (near Denver), the expansion of its existing greenhouses in Chicago and Providence, R.I., as well as future projects and acquisitions in other regions across the U.S. A recent Nielsen Total US xAOC study demonstrated that the company achieved a 26% year-over-year growth in the leafy greens category alone (compared to 3% and 2% YoY growth for conventional and organic sectors, respectively).

By 2023, Gotham Greens aims to own and operate 13 high-tech, climate-controlled hydroponic greenhouses, totalling more than 40 acres (1.8 million square feet) across nine states. The greenhouse expansion projects join Gotham Greens’ existing greenhouse farms in New York, Rhode Island, Maryland, Illinois, Colorado and California.

The New-York based company also announced the acquisition of Virginia-based FresH20 Growers.

Joe Van Wingerden, former owner of FresH2O Growers, Inc. says “Gotham Greens and FresH2O shared a desire to advance greenhouse agriculture and to bring more fresh, local and sustainably grown produce to consumers across the country, and we are confident they will continue to service our customers with high-quality, longer lasting leafy greens and other exciting innovations in the years to come.”

Little Leaf Farms Banks a USD 300 Million Funding

Little Leaf Farms raised USD 300 million in new capital in a funding round led by The Rise Fund, TPG’s multi-sector global impact investing strategy, and debt funding from Bank of America. The funding aims to support the company’s growth & expansion plans to make Little Leaf Farms’ lettuces accessible to more than half of the United States by 2026. To reach said goal the company will double the acreage of its current facility and open a new greenhouse in McAdoo, Pennsylvania this summer.

Indeed, the new state-of-the-art hydroponic greenhouse in McAdoo, PA will be the company’s fourth greenhouse and will enable the distribution of their produce throughout the Northeast. The McAdoo farm will increase the brand’s retail presence by 50%, with products available in more than 3,500 grocery stores.

The greenhouse will integrate all the innovations Little Leaf Farms’ has made in the past years, including energy efficient heating, cooling, lighting, use of advanced data analytics and hands’free automated grow systems. Using hydroponic methods, Little Leaf Farms grows its lettuce under glass and recycles rainwater, natural sunlights resulting in 90% less water consumer than filed-grown greens and solar panels to generate electricity.

The company plans to further their expansion in Pennsylvania and North Carolina to serve its growing customer base with the opening of several new greenhouses in these states. This aggressive growth plans enabled them to grow their retail sales by 50% representing, according to the company, 42% of the CEA lettuce produced in the US.

Pure Harvest Smart Farms Raised USD 180.5 Million

Pure Harvest Smart Farms (Pure Harvest), a leading indoor vertical farm headquartered in the United Arab Emirates (UAE), raised USD $180.5 million in their latest growth funding round. Led by a consortium of global investors, including Metric Capital Partners UK, IMM Investment Corp Korea & Olayan Group KSA among other existing investors and managers. The capital (along with other forms of debt financing) will be used to fund the company’s research and development, expand its footprint across the GCC as well as initiate an expansion across the Asian market. Citigroup served as an exclusive financial advisor to Pure Harvest.

The funding represents, according to the company’s statement, the “largest-ever” convertible financing in the MEASA region, and though, oversubscribed, the company states that other strategic investors are still in discussions for further upsizing the amount. The funding round further’s the place of Pure Harvest Farm as the region’s leading indoor vertical farming and one of the fastest growing companies in the sector, globally.

1/3 Of Investments Were Made in the United States But They Represented 2/3 of The Amounts Invested

As you can see in the pie chart above, nearly 1/3 of investments were made in the United States when looking at investments counts per country since the start of the year. Nonetheless, it represents 2/3 of the total investments made in 2022 as US based companies have raised about USD 1.5 Bn.

Are We Experiencing a Dangerous Investment Frenzy?

The question can be asked given that despite its promises, most indoor vertical farming companies are yet to be profitable given their high incremental investment and their high operational costs. The current macroeconomic environment cited at the beginning of this newsletter could lead to a swift reversal in investments made in the sector, in the US particularly.

Asked about the investments made in the sector, Ricky Stephens, Director of Director of Digital Strategy at Agritecture, comments:

"As Agritecture's CEO, Henry Gordon Smith, wrote about in AgFunder News last year, we seem to be experiencing an investment frenzy in the US around vertical farming at the moment. While there is plenty of market share still to be gained by CEA growers in the US leafy greens retail space, we worry that the source of so much of this funding being venture capital has led to unrealistic and unattainable growth projections. This will likely lead to some high-profile failures as targets are missed and capital dries up.”

Indeed, throughout the world, many indoor vertical farming companies are experiencing harder times or have filed for bankruptcy. In France, Agricool has filed for bankruptcy in the beginning of the year despite raising 30 million euros (USD 30 million) over time, Canada-based CubicFarm Systems have entered a restructuration phase laying-off about 16.5% of its workforce and this afternoon, Sifted.eu announced that German-based Infarm (a Unicorn company valued at > USD 1 Bn) is cutting its workforce to “secure its path to profitability”.

Though these examples are non-American companies, they may represent what lies ahead for indoor vertical farms in the US. Some publicly-traded companies such as Kalera KAL 0.00%↑ or Urban-Gro, Inc UGRO 0.00%↑ have reported worst-than expected quarters with Kalera incurring a net loss of USD 78.7 million in Q2 2022.

Peter Lane, a CEA Veteran, doubts the scalability of certain of these vertical farming solutions due to their complexity and cost.

“The true need in this industry is to simplify the processes. People talk of more and more sensors and control, but all they are doing is loading CAPEX and O&M budgets. I have commissioned many many systems over the last 40+ years, and adding more sensors to vertical farming is damaging and expensive. It is no wonder people are aghast when they are told how much it costs to build a vertical farm.”

Investors appear to fear on missing out investment opportunities in indoor vertical farming given the recent record-breaking fundraise. Nonetheless the added capital gives rise to unattainable objectives, as mentioned by Ricky Stephens, complexifying the processes when having simple technologies/ processes could open new markets…

“1/3rd of the world lives in Africa or India but they lack the knowledge and expertise in vertical farming and the systems of the USA and Europe being touted are not suitable due to complexity, and cost.” Adds Peter Lane “Vertical farming in Africa and India should be a no brainer but unlike the USA and the far east there are serious problems over funding, technical support and of course suitable systems. High tech and high cost systems in both continents are not suitable.”

He continues:

“An acre of good farm land in the UK costs about £2,000, a vertical farm with the same growing area is £8 million. (£2,000 m2 x 4046m2 in one acre), it is no wonder people are aghast when they are told how much it costs to build a vertical farm. Now think how unattainable those sort of figures are to some African or Indian grower. The big potential now is in the middle east, they are not worried about energy costs, they have the money and the imagination.”

“But as investors have over-indexed in the US market, we believe they have undervalued opportunities in much of the rest of the world, especially in regions where leafy green imports are higher than in the US and supply chains are under added stress." Says Ricky Stephens.

Concluding Notes

On a personal note, I have mixed sentiment regarding the investments made.

On the one hand, the fact that indoor vertical farms have been able to bank this much money is encouraging as it shows a relative “trust” investors may have on these technologies despite the economic times we are experiencing and the fact that most are yet to be profitable. It also shows that investors are willing to risk their money to find potential solutions for our currently broken food supply chain.

On the other hand, its concentration in a handful of countries (particularly in the United States) and companies may show that the market is starting to consolidate with few new actors to emerge in the upcoming months/years and harder times for “smaller startups”.

Also, the fact that investors are pouring most of the money into companies having developed their own IP and using it to grow produce that they sell under their own brand makes me wonder if the investments made are 100% due to the processes (which I don’t think) or perhaps facilitated with the real estate that these companies acquire. Indeed, the irony wants that these soil-less farming technologies need land to fuel their growth. They need to acquire or lease plots of land to build their facilities which appreciates their value and enables a greater leverage for future funding rounds. But this, will be discussed in a later episode…

Indoor Vertical Farming Newsletter® is a reader-supported publication. To receive our upcoming editions and support our work, consider becoming a free or paid subscriber.