Greenhouses: Growing Too Fast?

Every Wednesday, discover an editorial on a relevant and important topic related to indoor farming.

Greenhouse farming is a segment of Controlled Environment Agriculture (CEA) where growers can leverage different levels of climate-controlled environments and off-soil techniques to grow various fruits, vegetables, and flowers at different scales. Greenhouses are nothing new as we trace similar growing methods back to the Roman empire, where emperor Tiberius ate cucumbers on a daily basis thanks to a look-alike of a greenhouse 'system'.

Recent Developments

Greenhouses always had an important place in the farming industry worldwide but in recent years, funding rounds for new greenhouse technologies, expansion projects, and record-breaking IPOs have skyrocketed leading the sector to reach new heights.

Funding Rounds

Indeed, in 2022, we’ve seen three notable USD 100M+ funding rounds from Pure Harvest Smart Farm, Little Leaf Farms & Gotham Greens.

Pure Harvest Smart Farms, based in the United Arab Emirates (UAE), raised USD $180.5 million led by a group of international financiers. The funds are to be used to finance the company's R&D, increase its presence throughout the GCC, and start an expansion into the Asian market. In October, A USD 50 million first investment in Pure Harvest was disclosed by IMM Investing Corp, the top alternative investment company in Korea.

Little Leaf Farms successfully raised USD 300 million in additional financing, which will support the business's expansion goals. Their fourth hydroponic greenhouse for Little Leaf Farms will be located in McAdoo, Pennsylvania, and it will allow the firm to distribute its vegetables throughout the Northeast. Products will provide the brand with a 50% retail presence boost, with more than 3,500 grocery shops carrying them.

Finally, A New York-based indoor farm called Gotham Greens has received more than $310 million in fresh funding. The company's most recent and most significant fundraising round involves both stock and loan financing. Gotham Greens intends to "accelerate its mission to decentralize agricultural production" with the help of the funding.

Mega-Projects

A USD 25 million guaranteed loan has been given by the USDA to North Country Growers, an American Ag Energy affiliate. Two 10-acre greenhouses are being built by the firm in New Hampshire, and when finished, they will produce 8 million pounds of tomatoes and up to 15 million heads of lettuce yearly. 80 to 85 jobs are anticipated to be created by the project for nearby communities.

The purchase of a five-acre greenhouse facility in Grand Rapids, Michigan, by Edible Garden AG has been finalized. By the end of the year, the new CEA facility, utilizing cutting-edge AgTech, is anticipated to be completely operational. Modern research and development will be conducted at the facility for the company. The exclusive hybrid vertical growing system developed by Edible Garden will also have its first commercial installation there.

Singapore Food Agency (SFA) and Pure Harvest Smart Farms, United Arab Emirates (Pure Harvest) signed a Memorandum of Understanding (MOU) to develop Singapore's first high-tech hybrid greenhouse tomato farm. The project will leverage on technical, operational, and sustainable farming expertise of Pure Harvest. It will also offer R&D opportunities for local partners, as well as contribute to Singapore's "30 by 30" food security goal.

AppHarvest completed the calibration of its "touchless growing system" for salad greens at its 15-acre Berea, Ky., indoor farm. The hands-off system helps to improve both food safety and efficiency. The company is approximately 80% complete with the planting of its 30-acre AppHarvest Somerset Farm. It also continues construction on its 60-acre Richmond, Ky. farm, which will double the capacity to grow tomatoes.

Local Bounti Corporation announced the start of operations in its new innovative controlled environment agriculture (CEA) facility in Byron, Georgia. The expansion of the 3-acre facility will double the capacity to 6 acres and has the opportunity to expand to 24 acres. The company is also working on a new greenhouse in Pasco that will further expand the company's production and its retail distribution in the country.

Recent IPOs and M&As

A news statement announcing the signing of a binding business combination agreement between Nature's Miracle Inc. and Lakeshore Acquisition II Corp LBBB 0.00%↑. The deal is anticipated to be completed in the first quarter of 2023. The shareholders of Nature's Miracle (the "Company Stockholders") will receive 230,000,000 shares of Lakeshore common stock in exchange for their equity securities. Nasdaq Global Market trading for the firm is anticipated. Upon completion, it is anticipated that the merged business would adopt the name Nature's Miracle Holding Inc.

In its public offering, Edible Garden AG EDBL 0.00%↑ priced 2,930,000 shares of its common stock at $5 each, generating roughly $14.7 million in gross revenues. On May 5, 2022, the warrants and common stock started trading on The Nasdaq Capital Market.

Additionally, FresH2O Growers, Inc., a hydroponic greenhouse grower in Stevensburg, Virginia, was just acquired by Gotham Greens. Mid-Atlantic supermarket shops carry the company's leafy green salad goods. Joe Van Wingerden, the former proprietor of Fresh2O Growers, said, "We are happy to transmit the torch of the greenhouse facilities and business to Gotham Greens.

In a USD 122.5M deal, Local Bounti LOCL 0.00%↑ acquired Hollandia Produce creating one of the biggest CEA enterprises in the US. Pete's has three greenhouse growing facilities, two of which are now operational and one of which is being built in Georgia. The company has been in business for more than 50 years and has spent the last 25 years concentrating on leafy greens.

The Sector Faces Numerous Challenges

Lighting pollution:

Several greenhouses light their facilities at night which contributes to lighting pollution and affects wildlife as well as the neighborhood which forces certain policymakers in France for instance, to rethink the legislation in terms of Lighting periods during the night, especially in an era where urban cities, mayors and people are forced to restrict the luminosity in the streets.

Energy Problems:

Linked to the lighting requirements of certain of these facilities, energy is an increasing problem as the current prices have forced greenhouses in Europe to rethink their operations, halt their production, and even go bankrupt as the operational expenditure of such facilities far exceeds the retail prices of the produce. Energy is used not only to power the LED of modern greenhouses but also to maintain a certain environment to ensure stable plant growth throughout the year. Corenthin (Félix) Chassouant, agronomist (MSc) and greenhouse specialist argues that more advanced facilities may find it more difficult to cope with these prices in North America.

“The situation looks ‘better’ in North America but prices vary and Northern regions of the United States hit by recent cold weather have had their energy bills increase. I believe that the horticulture (flowers) and leafy-green growers (requiring less heat) will be able to reduce their energy consumption and that overall, the US growers may be more resilient to cope with inflation rates but not all crop growers will have the same resilience (Especially cannabis & hemp growers requiring extensive energy to control the environments) and moreover, questions remain as to whether consumers will be able to cope with the current prices” comments Corenthin Chassouant, Export Sales Director at HARNOIS Greenhouses.

Impact of Climate Change:

Depending on the material used for the greenhouse, certain facilities have faced important damages due to climate change and its subsequent climate hazards. In fact, hail, storms, cyclones, and other events, caused important casualties to certain facilities who had to halt their operations or worse, lost all their production for the summer.

Outlook on the sector

As with other sectors, the current macroeconomic trend is affecting companies along the supply chain having to face increasing energy costs, increasing consumable costs as well as a need to produce an increasing variety of crops.

The energy dilemma: How can greenhouses decrease their energy consumption and subsequentially increase their profits?

It is prevalent, in any form of controlled environment agriculture to reduce energy consumption and find systems that are flexible enough to be adapted in various locations.

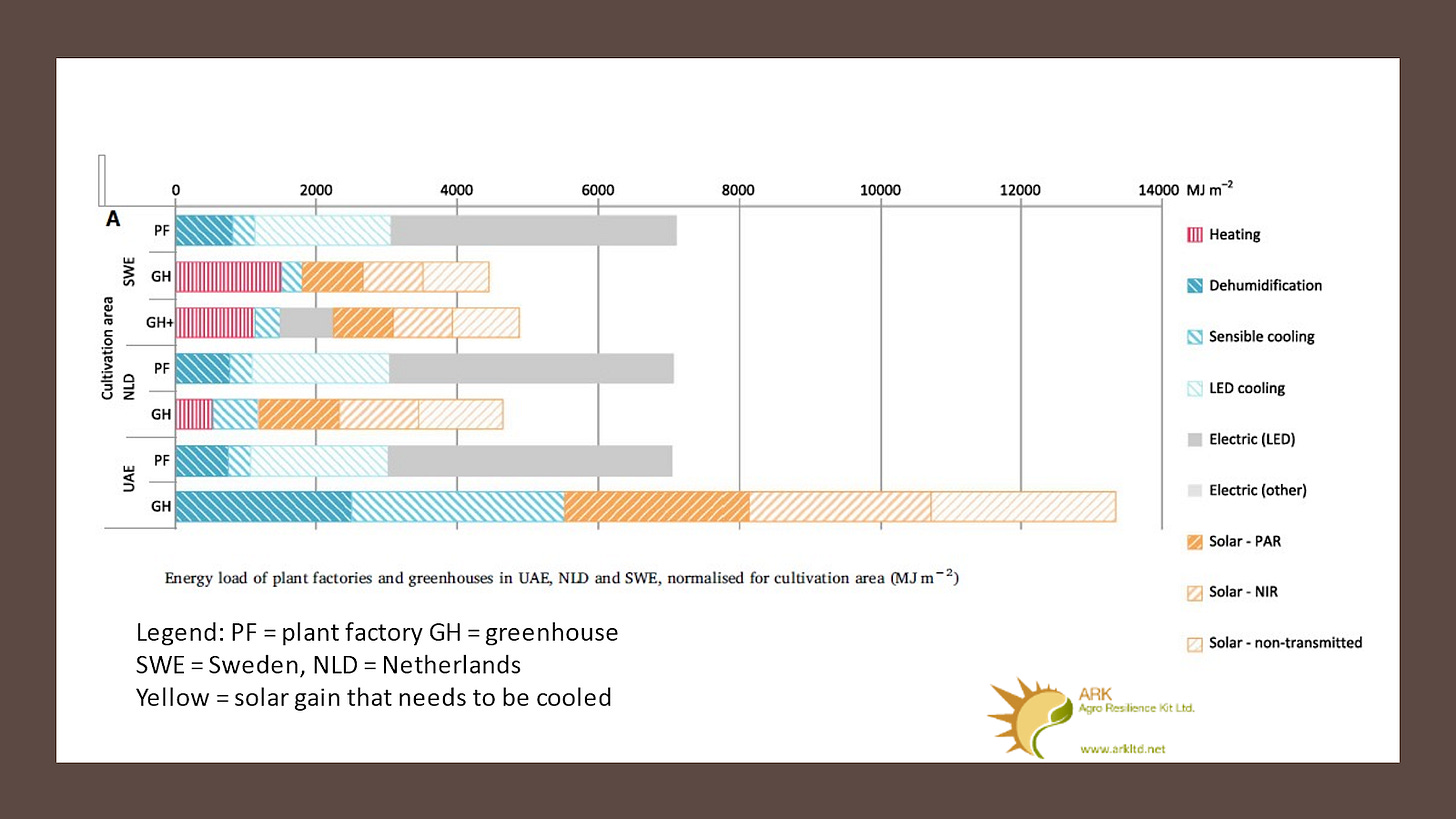

“Dehumidification/cooling are the biggest costs for all plant factories and greenhouses in hot climates but there are options to create competitive cost advantages. Essentially air management techniques enable us to cool a 1/10th of an acre greenhouse or any building using about 2kWh of electricity to operate a water pump. But we can go well beyond this and use concentrated solar to generate hot water or steam and then we can use the heat to create chilled water using technologies first deployed in the early 1900s and available from various large MNCs. There is a wealth of passive energy techniques that can be used in order to reduce energy consumption.” comments Dan Cloutier, President of ARKLtd.net

Dan also argues that beyond passive energy techniques, the choice of material in your greenhouse is important as certain conventional greenhouse structures see heat loss and thus additional costs incurred by the growers.

“Tensioned membrane solutions enable taking advantage of all the free energy gain in addition to giving unparalleled air tightness which truly is the first defense to energy efficiency. Conventional greenhouse structures typically see heat loss double as wind speed goes from 0 to 15 miles per hour whereas our tensioned membrane buildings do not” He adds.

Adding to it, Corethin Chassouant mentions the importance of preparing well a project to have all information in hand to anticipate certain fluctuations and stay profitable and efficient.

“Based on my experience, every project is unique, with its own set of variables to consider (Environment, Crops selected, Seasonality…). In most cases, a mid-tech greenhouse combining passive and active climate control strategies will be the best system for your project.” Corenthin mentions

In addition to the choice of materials and use of passive energy methods, the use of artificial intelligence and machine learning can assist growers in enhancing their operations, decreasing their costs as well as their energy consumption.

“Artificial intelligence is catalyzing growth in the greenhouse industry. Leading operators are using machine learning and AI platforms like IUNU’s LUNA AI to drive efficiencies and increase profits. This, in turn, opens opportunities to scale and open additional locations despite grower shortages” comments Allison Kopf, Chief Growth Officer at IUNU

Emerging crops segments

For the past couple of years, we’ve seen an increasing number of fruit crops being grown in greenhouses as a mix of extreme climatic events, and the need to enhance production outputs forces growers to move indoors.

“In the future, an increasing number of growers will have to find new ways to protect the crops and continue growing. In some cases, greenhouses will offer a viable solution for optimal growing conditions for fruit trees in regions lacking water as facilities can be adapted to easily collect and save water for future irrigation. Moreover, not only is water consumption reduced but integrating pest management strategies to grow organically is possible thus offering future segments for the greenhouse sector” mentions Corenthin

Corenthin has been able to see examples of fruit trees grown in greenhouses in Malaysia where dwarf mango trees were grown to produce fruits for the Japanese market and in Colombia where a company was growing hydroponic uchuvas (Peruvian Groundcherry) shrubs under a low-tech poly greenhouse to increase the fruit quality optimizing the fertilizers inputs.

Dan Cloutier also believes that the segment is emerging for certain fruit crops and a space to watch in the coming years:

“This is a segment we have worked on to determine economic viability. Revenue per square foot is one key so bananas for example did not seem to pencil out so well due to fruit available over a year per square foot. Nevertheless, the space is interesting and maybe all the most so with mixed-use spaces. The Eden Project albeit massive seems from what I am aware of to be a benchmark of success.” mentions Dan Cloutier

Labor issues experienced across the sector

An increasing number of greenhouses experience hard times in finding competent/qualified growers as the number of greenhouses expands and the generations operating these greenhouses age.

“One of the dangers will be to find head growers and labor to run the existing and new greenhouses. A part of the industry will have to renew itself with a new generation in North America,” comments Corenthin

“We have an unprecedented shortage in grower expertise. As companies continue to expand, it’s increasingly difficult to staff facilities hence the increasing use of technology to fill the gap” comments Allison.

I would like to thank Dan Cloutier, president of ARK Ltd, Corenthin Chassouant of Harnois Industries and Allison Kopf of IUNU for their valuable insights and contributions.