Are We On a Path To Profitability For Indoor Farming Stocks?

Most indoor farming companies have reported their earnings for the quarter with some positive surprises and some disappointments.

Most indoor farming companies have reported their earnings for the quarter and while some have disappointed investors by failing to meet revenue & earnings per share (EPS), others have positively surprised investors with better than expected results. Indoor farming companies are often criticized for their ‘unsustainable finances’ with high costs associated with operating/acquiring their systems.

Indeed, most publicly-traded indoor farming companies are yet to be profitable, incurring important losses quarter after quarter mostly because of the current macroeconomic uncertainty driven by geopolitical tensions, exponential inflation rates, the aftermaths of COVID, and recession fear. As a result, companies are taking initiatives to decrease their cost, increase their revenue by building more facilities, and improve their system’s costs.

But are they taking the path to profitability?

Indoor Farming Performance For The Quarter

AppHarvest (NASDAQ:APPH) Beats Earnings Per Share Expectation But Misses On Revenue Despite Scaling Up its Facilities

For the second quarter of 2022, the Morehead, KY-based company achieved net sales of USD 4.4 million (6 million pounds of Tomato sold at 72 cents) representing a USD 1.3 million increase in revenue compared to the second quarter of 2021. The company sold its tomato at double the price from Q2 2021 (36 cents in 2021 compared to 72 cents in 2022) because of market conditions (inflation) and a better quality of its produce thanks to “better training and productivity improvements” as mentioned by the company in its press release.

AppHarvest also incurred a net loss of USD 28.7 million compared to a prior USD 32 million net loss because of its increase in the number of facilities and starting operations for most of them.

Local Bounti (NYSE:LOCL) Misses on Earnings per Share by USD 12 cents But Beats Earning Estimate By USD 410K

On the 15th of August, Local Bounti reported its financial results for the second quarter 2022. The company achieved sales of USD 6.3 million compared to USD 108K in the prior year period. The improvement was driven by the 52% increase in revenue from the company’s Hamilton, MT facility as well as the revenues generated from the facilities belonging to Pete’s before its acquisition in Q1 2022.

The company nonetheless, incurred a net loss of USD 31.7 million in Q2 2022 a USD 24 million compared to Q2 2021. The increase is explained by a number of reasons according to the company. Indeed, Local Bounti faced the effects of global supply chain disruptions resulting in a higher cost to fill orders as well as a number of costs linked to its debt facility with Cargill (USD 5.5 million in interest expense).

Urban-Gro (NASDAQ:UGRO) Misses on EPS & Revenue Expectations

The Colorado-based company, though reporting an improvement in its revenue (USD 16.3 million for the quarter, a USD 3.5 million increase) driven by the acquisition of Emerald Construction Management & 2WR, has missed its revenue expectations by nearly USD 3 million. The company nonetheless stated in its press release more than USD 22 million in backlog was registered (unrealized revenue from contracts/ commitments made during the quarter).

Gross profit margin decreased compared to Q2 2021 by 1% and operating expenses were USD 5.4 million nearly double what it was during Q2 2021. The company explains this increase in increase in headcount to support both current and future demand for the company’s solutions, continued investment in European growth, as well as the incremental costs associated with acquisitions.

The company also registered a net loss of USD 1.7 million or USD 17 cents per share compared to a net income of USD 1.3 million or 11 cents per share in the prior year-end.

CubicFarm Systems Corp. (TSE:CUB) Reports A Revenue Improvement and Cost Reduction Measures For Sustainable Growth

For the quarter, the Canadian company achieved CAD 2.9 million in revenue up from CAD 0.4 million in the prior period. Q2 revenue included sales of its CubicFarm & Hydrogreen modules for CAD 2.7 million. The company posted CAD 3.1 million in revenue, a decrease of CAD 1.2 compared to the prior period (CAD 4.3 million).

Net loss for the three and six months ended June 30, 2022, was $9.1 million and $17.9 million respectively, compared to a net loss of $6.5 million and $10.1 million in the prior period. The increased net loss in the current quarter reflected the Company's continued expansion through staffing additions in the areas of research and development and general operations.

Nonetheless, The Company currently has a total of 223 modules pending manufacturing and installation, with a total estimated contract value of USD $30.7 million. In addition, the company has laid off 16% of its workforce to bolster the company's finances and enable long-term sustainable growth.

Agrify (NASDAQ:AGFY) Beats Revenue Estimates But Reports an Important Net Loss

Revenue was $19.3 million for the second quarter, an increase of 63.5% compared to $11.8 million for the prior year period. The company also improved its gross profit reaching USD 1.6 million or 8.3 of revenue, compared to USD 527K, or 4.5% of revenue in the prior year period.

Operating expenses reached USD 93.1 million for the quarter compared to USD 6 million in the prior year period. The increase is explained by the company by the USD 69.9 million impairment charges, increases in reserves associated with accounts receivable, loans receivable, inventory obsolescence, and warranty costs, increases in depreciation and amortization, and changes in contingent consideration related to the fair value estimates associated with ongoing acquisition-related earnout arrangements. This led to a net loss of USD 93.4 million for the quarter compared to USD 5.6 million in the prior year period.

Adjusted EBITDA (a non-GAAP financial measure) was a loss of $19.4 million in the second quarter, compared to an Adjusted EBITDA loss of $4.5 million in the prior year period. Adjusted EBITDA was a loss of $25.5 million in the year-to-date period, compared to an Adjusted EBITDA loss of $8.7 million in the prior year-to-date period.

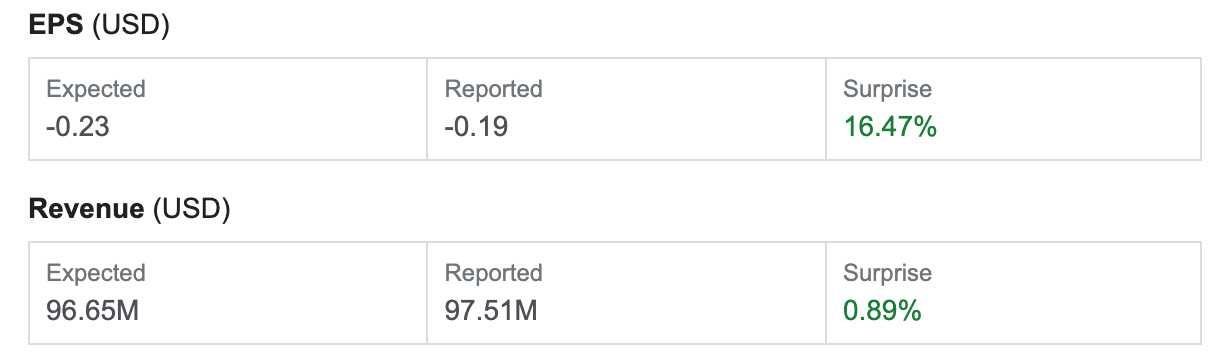

Hydrofarm Holdings Beats EPS & Revenue Estimates

The company reported a net sales decrease of USD 97.5 million compared to USD 133.8 million in the prior year and a net loss of USD 203 million for the quarter.

Net sales in the second quarter of 2022 decreased to $97.5 million compared to the second quarter of 2021, driven by an approximate 29.9% decrease in volume of products sold, offset by an approximate 3.1% increase in price and mix of products sold, and an approximate 0.3% decline from unfavorable foreign exchange rates. The decrease in product volumes was primarily related to an agricultural oversupply, partially offset by a 13.5% benefit from recently acquired proprietary brands.

The adjusted gross profit margin was negatively impacted by a $10.2 million increase in inventory reserves primarily related to lighting products. During the second quarter of 2022, the company stated experiencing higher freight and labor costs, partially offset by pricing actions and a favorable sales mix of the Company’s proprietary brand products compared to the prior year period.

What Affected Their Performance?

Most companies have stated inflation as the primary reason for their performance as even if it has for some growers improved their revenue with higher sales (AppHarvest sold its tomato for 72 cents a pound compared to 36 cents in the previous year period), it increased in the same time their operating expenses as indoor farming companies are facing price hikes in the logistics (distribution of their produce is more expensive) as well as the soaring energy prices.

Supply Chain disruptions have also impacted their growth as companies were facing delays in supply (Local Bounti) which slowed down the construction rate of their facilities and pushes back future revenue streams.

Fears of recession have also impacted the company’s performance as many were affected by a decrease in demand (especially visible for Cannabis stocks and equipment/ consumable sellers) as shown by the Conference Board Consumer Confidence Index® decreasing in July, following a larger decline in June.

As per Conference Board’s latest press release the index now stands at 95.7, the Present Situation Index—based on consumers’ assessment of current business and labor market conditions—fell to 141.3 from 147.2 last month. The Expectations Index—based on consumers’ short-term outlook for income, business, and labor market conditions—ticked down to 65.3 from 65.8.

“Consumer confidence fell for a third consecutive month in July,” said Lynn Franco, Senior Director of Economic Indicators at The Conference Board. “The decrease was driven primarily by a decline in the Present Situation Index—a sign growth has slowed at the start of Q3. The Expectations Index held relatively steady, but remained well below a reading of 80, suggesting recession risks persist. Concerns about inflation—rising gas and food prices, in particular—continued to weigh on consumers.” She adds: “As the Fed raises interest rates to rein in inflation, purchasing intentions for cars, homes, and major appliances all pulled back further in July. Looking ahead, inflation and additional rate hikes are likely to continue posing strong headwinds for consumer spending and economic growth over the next six months.”

Cannabis and other produce are affected by this confidence decline as demand decreases and companies rethink their full year guidance.

A Path To Profitability?

We recently covered the recent trend that we saw regarding the expansion of indoor farming companies. Publicly-traded companies have initiated an expansion phase to meet increasing demand, examples include among other:

AppHarvest (NASDAQ:APPH)

AppHarvest, Inc. announced the start of construction for two new high-tech indoor farms in Central Appalachia. The company’s new farms, located in Somerset and Morehead, Ky., will grow berries and leafy greens, respectively. The high-tech Somerset farm marks the company’s expansion into growing berry crops. The Somerset indoor farm will be 30 acres.

Local Bounti Corp (NYSE:LOCL)

Local Bounti Corporation (NYSE: LOCL, LOCL WS), announced the start of operations in its new innovative controlled environment agriculture (CEA) facility in Byron, Georgia. This is Local Bounti’s fourth facility and was the facility under construction when Local Bounti acquired Pete’s.

CubicFarm Systems Corp (TSE:CUB)

As the Company’s North American manufacturing partner, NTE Discovery Park will be manufacturing major hardware components for CubicFarms. Supply chain delays have impacted the Company’s delivery and installation of CubicFarm System modules during the ongoing global pandemic. This new manufacturing agreement with NTE Discovery Park will mitigate supply chain constraints and allow increased efficiencies and new Farmer Partner installations for larger commercial scale commitments.

Concluding Notes:

Publicly-traded companies are making efforts to make their business model more efficient, increase their production output and decrease their operating/ incremental expenses. The effects of these efforts will be seen from the fourth quarter 2022 onwards as most facilities will be operating at full capacity and cost reduction measures would have its first effect on the financial results of the indoor farming companies.

Beyond the financial matter, companies are also increasing sustainable solutions relying on greener energy sources, and decreasing the energy consumptions of their product.

The current uncertainty remains regarding the macro-economic conditions, how inflation and recession fears will further affect their financial performance, also, the current tensions with Taiwan (a leading LED manufacturer needed for most of these facilities) may lead to additional losses incurred before the first effects of the CHIPS act in the United States.

Do you have any insight about Edible Garden (EDBL)?